Resilience Bond for risk reduction

In a nutshell

At a global level, there is a significant shortfall in funding for projects that protect communities from natural disasters.

The associated risk is compounded by a gap in insurance coverage, leaving vulnerable communities and government agencies underprotected in the face of ever more frequent and severe extreme events. One new financing mechanism to bridge this gap and increase both physical and financial protection is the resilience bond, a variation on conventional catastrophe bonds. Resilience bonds value the reduction in disaster-related expected loss from the implementation of resilience projects through a rebate structure.

Investment and operating model

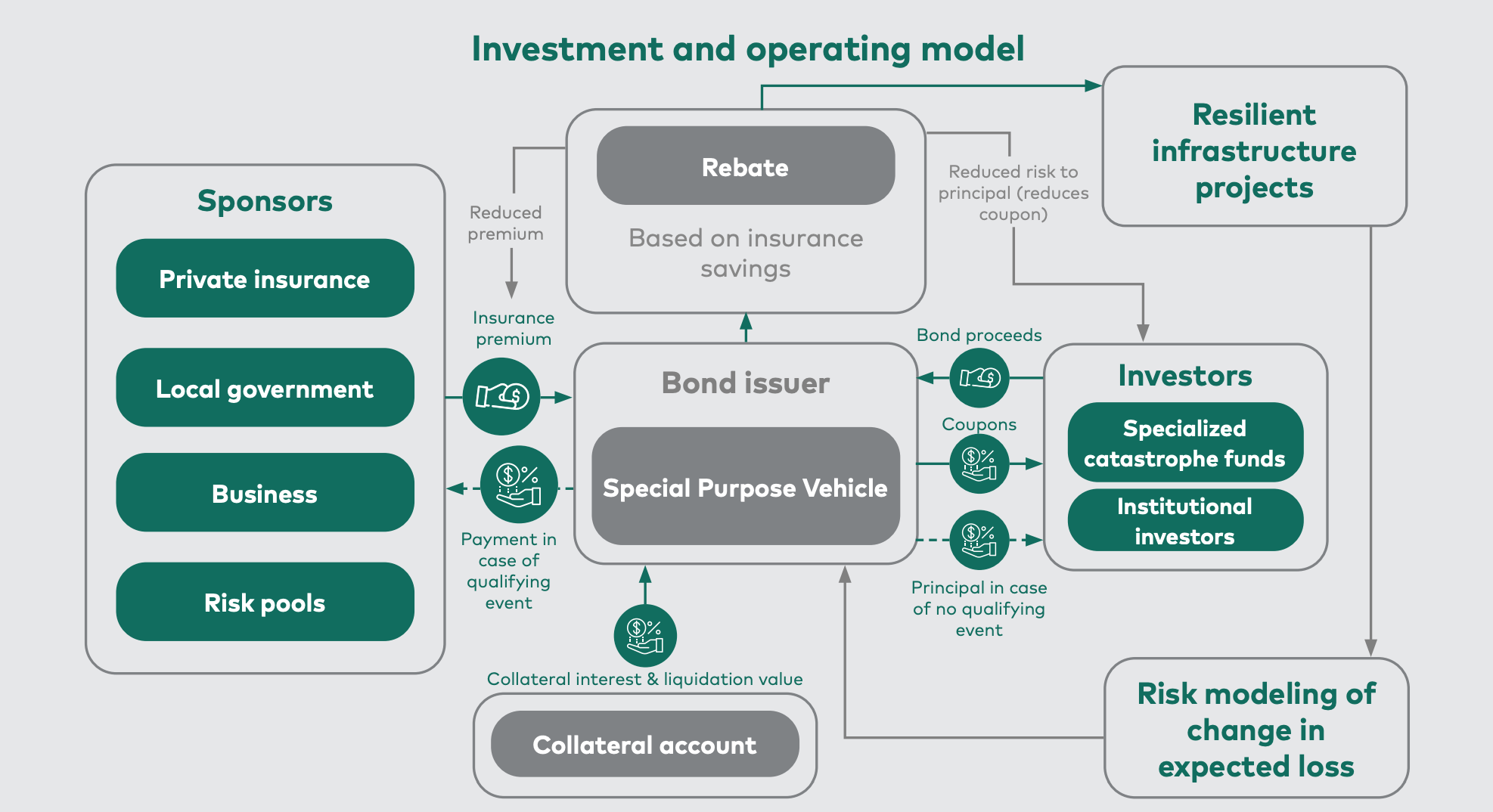

A resilience bond is a new insurance instrument designed to help governments increase both their financial insurance and physical protection against disasters. These bonds link insurance coverage that public entities can already purchase with capital investments in resilience projects that reduce the expected losses from disasters.

The resilience bond model is based on conventional catastrophe bonds, which comprise: (i) an insurance product providing coverage to the bond sponsor; and (ii) a debt instrument sold to investors to collateralize the insurance coverage. The issuer deposits the proceeds into a collateral account and makes fixed coupon payments to investors. It returns the principal to investors when the bond comes to maturity, unless a qualifying natural disaster occurs, in which case it uses the principal to pay out the sponsor.

The novelty of the resilience bond is that bond investors agree in advance to discount the coupons they receive when specific risk-reducing projects are completed during the bond term. The bond issuer uses financial catastrophe models to validate whether a resilience project will reduce expected losses. This sets the reduction in coupon payments to investors. The cost savings from this reduction are distributed back to the sponsor in the form of a resilience rebate, which can be used to finance risk reduction investments.

The bonds are typically short-term securities, to reduce the risk to investors. Unless the bond is privately placed, investors can sell catastrophe bonds they already own on the secondary market.

Impact measurement

Example of metrics that may be used to assess the impact of a resilience bond include:

- risk reduction and community-centric metrics, e.g. percentage of population or asset exposure covered by insurance, the percentage of eligible upgrades under the insurance-linked upgrade program, and the percentage actually upgraded;

- ecological resilience metrics, such as percentage of land covered by the insurance policy that is considered resilient against a 100-year, 250-year and/or 500-year event

- additional conservation metrics, such as percentage of resilience budget allocated to green infrastructure projects, and/or area of coastline rehabilitated/restored per dollar spent.

Scalability and replication

Resilience bonds are applicable globally and provide a sustainable approach to driving project investments and insurance penetration, not only by promoting financial protection against natural disasters, but also by financing increased resilience to future losses. Scaling up resilience bonds for green and natural infrastructure projects will depend on advancements in catastrophe modeling methodologies to robustly link reduction in expected losses from natural and green infrastructure projects to natural capital assets. To start with, resilience bonds may tackle natural disaster risk reduction projects where there is existing financial protection, a track record of catastrophe bond issuances, and for which green infrastructure has been proven effective in reducing physical risks.